Are you OK?

Hopefully, somebody has already asked you this question if you’re recovering from a car accident that may have totaled your vehicle.

To make your day a little easier, we talked with the experts in our claims team to give you in-depth answers about what a totaled car is and what happens next.

- What is a totaled car or vehicle?

- What is the typical process of a totaled vehicle insurance claim?

- What happens to my vehicle after it's totaled?

- Do I need to pay my deductible when my vehicle is totaled?

- What happens if my vehicle is totaled with a remaining loan balance?

- Why is my vehicle worth less?

- How long can I have a rental vehicle when my car is totaled?

What is a totaled car or vehicle?

A vehicle is typically considered totaled when it isn’t economically reasonable to repair the vehicle.

There are many variables considered when determining if repairing the vehicle makes sense, including:

- Vehicle age

- Vehicle mileage

- Points of impact from the accident

- Repairability

- Airbag deployment

If the cost of repairs exceeds the value of your vehicle, most insurance companies won’t pay to make those repairs and will consider the vehicle a “total loss” or totaled.

For example, if your vehicle is valued at $10,000 and the cost to repair the damage from an accident is $15,000, it would not make financial sense to repair your car. In this situation, your insurance company will likely record it as totaled. Then, they will issue you a payment for the value of the vehicle that was totaled.

What is the typical process of an insurance claim for a totaled vehicle?

First, report your claim

How you report your claim depends on your insurance company. For Auto-Owners policyholders, contact your local, independent agent or utilize our afterhours phone number, as needed.

A claim representative will evaluate your vehicle

Upon inspection of your vehicle, you will hear back from your insurance company whether your vehicle is repairable or totaled.

Some situations may make this timeline a little bit longer, like when your car is totaled as part of a natural disaster and there are hundreds of other vehicles waiting to be evaluated.

However, this is not a time to wait around. Use this time to get started on a few tasks to help you recover quickly if your vehicle does turn out to be totaled, such as:

- Find your vehicle’s title

- Clean out your belongings from the vehicle

- Begin searching for another vehicle

Find your vehicle’s title and clean out your belongings

As soon as you can, remove all your belongings from the vehicle and find your vehicle’s title. If your vehicle ends up being totaled, it will be towed to a salvage yard, so getting your items out now is important.

Find a rental vehicle

If your auto policy has rental coverage on it, you have the option of renting a vehicle after your car is totaled.

But, before you skip off to find a rental car, check your auto policy to see how many days your policy covers and the dollar limit, so you aren’t surprised later.

You can also reach out to your insurance agent or company for clarity.

A common misconception is you have coverage for a rental vehicle until you find a replacement vehicle. That is not true. You usually have a rental vehicle for only a set number of days after your vehicle is considered a total loss, specified in your auto policy.

Start searching for a replacement vehicle

During this time, it’s also wise to start looking for a replacement vehicle. The payment you receive from your claim will be the current market value of your totaled vehicle, before damage.

You can also reach out to your claims representative to get an idea of what amount you may receive from your claim. Keep in mind that before your vehicle is considered totaled and a market valuation is determined, this is only an idea of what your vehicle may be worth.

Receive your claim payment

Lastly, your insurance company will issue you a claim payment. Keep in mind, you’re going to be compensated the value of the totaled vehicle, before damages. Depending on your insurance company, this may be a paper check, a payment card or a deposit into an account.

What happens to the vehicle after it is totaled?

When your vehicle is determined to be totaled, it will be sent to a salvage yard. There may be some time before the vehicle is picked up and towed, which is a good time to make sure all your personal belongings are out of the vehicle if you haven’t already removed them.

There are situations where your vehicle is towed to a salvage yard right after the accident. In that situation, you will want to reach out to the yard for help recovering your belongings.

If your vehicle is towed but your insurance company does not consider it totaled, it may be towed back to you.

Do I need to pay my deductible when my vehicle is totaled?

In most cases your deductible will be taken from your claim’s payout amount. So, you likely won’t have to submit a payment for your deductible. It will just be deducted from the payment you receive from your insurance company.

What happens if my vehicle is totaled with a remaining loan balance?

Your insurance company will pay off your remaining balance, and the remaining equity goes back to you.

If you have negative equity, meaning your loan exceeds the payment amount you’re receiving from your insurance company, the titled owner of the vehicle will need to pay what’s left of the remaining loan amount.

This is why Auto Loan/Lease coverage (sometimes referred to as gap insurance) is so important. It covers this leftover amount when your car is totaled, but has a remaining loan amount after your claim payout is applied. Talk to your agent to discuss if you may benefit from gap insurance.

Let’s look at an example of how this coverage works:

Let’s say your car is totaled after a bad accident. Your car’s current value is $10,000. You have a loan on this vehicle. Your remaining loan amount is $15,000. Your insurance company is going to pay you the current value of your car ($10,000). This leaves a remaining $5,000 balance on your loan, which you will need to pay. If you have Auto Loan/Lease coverage, it may pay the remaining $5,000 for you.

Why is my vehicle worth less?

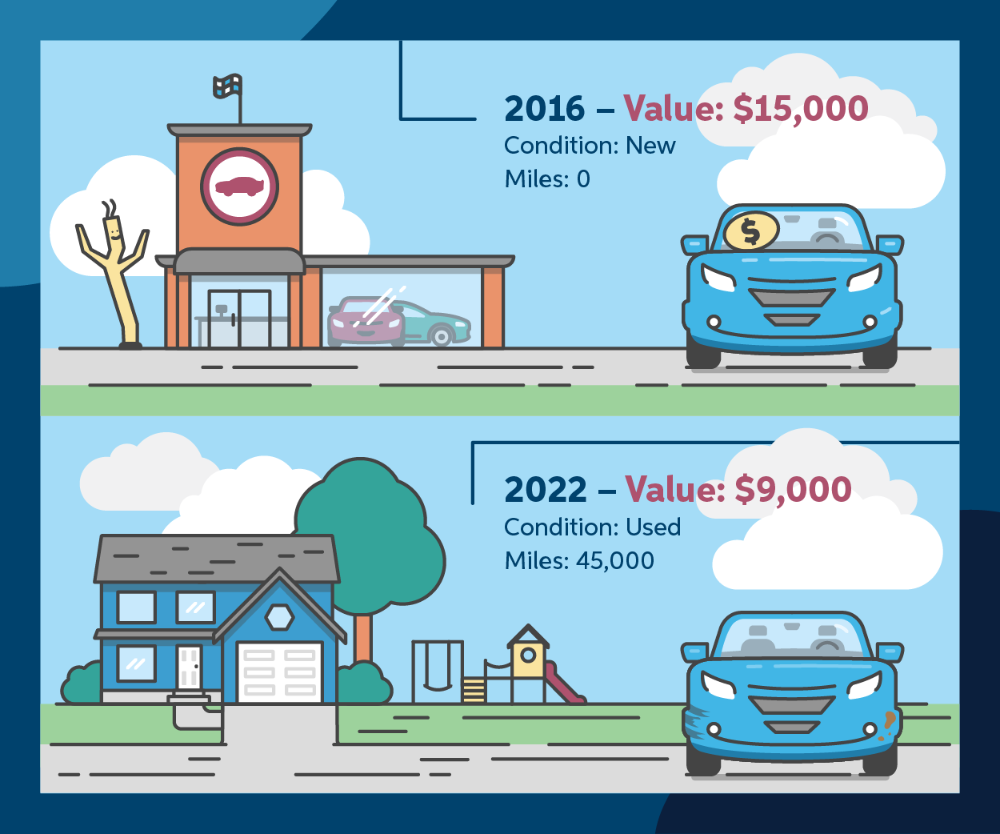

One of the areas of misconceptions when it comes to totaled vehicles is the worth of the damaged vehicle. Oftentimes people expect to receive a claim payment to cover the cost of a brand-new vehicle, or a vehicle that is newer than the one that’s totaled.

However, this is not what most policies provide. Your insurance policy will pay the actual cash value of the damaged vehicle, which is the amount you would pay for that vehicle today.

One way to look at this is to remember that an insurance claim is not a refund on that vehicle. This means you’re not going to get the exact amount you paid for that vehicle back.

You will be paid the actual cash value of the damaged vehicle. This is an important distinction. The goal of insurance is to help you get your life back to where it was before the accident/loss.

Some insurance companies offer additional coverages that allow you to be compensated the purchase price of your vehicle rather than the actual cash value. Typically, these are only available for newer vehicles.

At Auto-Owners, these coverages are the Purchase Price Guarantee coverage and the Total Loss to a New Automobile coverage. Talk to your agent to see how these coverages can benefit you.

How long can I have a rental vehicle when my car is totaled?

Every auto insurance policy is different, so look at your policy to find how many days and what dollar limit you may have for rental car coverage. Notice it is a specified number of days after your vehicle is considered a total loss, not just however long you need it to find a replacement vehicle. This is another reason why starting your search for a replacement vehicle quickly is important.

We hope you’re safe and back on the road soon! To learn more about the car insurance coverages mentioned in this article, talk to us today!

Auto-Owners Insurance Company © 2022. All Rights Reserved.

Disclaimer: The analysis of coverage is in general terms and is superseded in all respects by the Insuring Agreements, Endorsements, Exclusions, Terms and Conditions of the Policy. Some of the coverage mentioned in this material may not be applicable in all states or may have to be modified to conform to applicable state law. Some coverages may have been eliminated or modified since the publishing of this material. Discounts may not be available in all states. Limitations and conditions may apply.