Welcome to the right place to learn everything you need to know about insurance premiums, insurance deductibles and limits!

Let’s get right to it.

What is an insurance premium?

Your insurance premium is what you pay monthly, quarterly, semi-annually or annually, depending on the billing option you selected, for your insurance policy. People sometimes call this their “rate.”

If you shop for insurance online and look at quotes, you are really looking at the different amounts you may pay for your premium.

Your insurance premium factors in several things, like:

- Your policy’s limits

- Your policy’s deductibles

- Insurance claim history

There may be other components that go into your insurance premium depending on the type of policy and sometimes even the state you live in.

Why did my insurance premium change?

Many things can impact your premium and cause it to change. For example, inflation can impact how much it costs to repair or replace your house or car.

Overall reasons your premium may change include:

Overall reasons your premium may change include:

- Inflation

- Your insurance claim history

- Adding coverages

- Increasing your policy’s limits

- Adding family members to your policy (like a new driver)

- Changes to your house or vehicle

- Changing what you use your house or vehicle for, like renting out a room in your home

- Your driving record

Insurance premium changes are a big pain point for many people. When it changes, you notice.

Ready for a strange example?

If you were to buy all the milk you need for one year, you would likely notice a big difference in price when you go to buy all your milk the following year. That’s because you’re looking at inflation in one large lump sum.

So, changes in premium are more noticeable because the only time most of us review our insurance premium is when we pay of bill for the next policy term.

What is an insurance deductible?

Your insurance deductible is the portion of a covered claim that you pay.

Your insurance deductible is the portion of a covered claim that you pay.

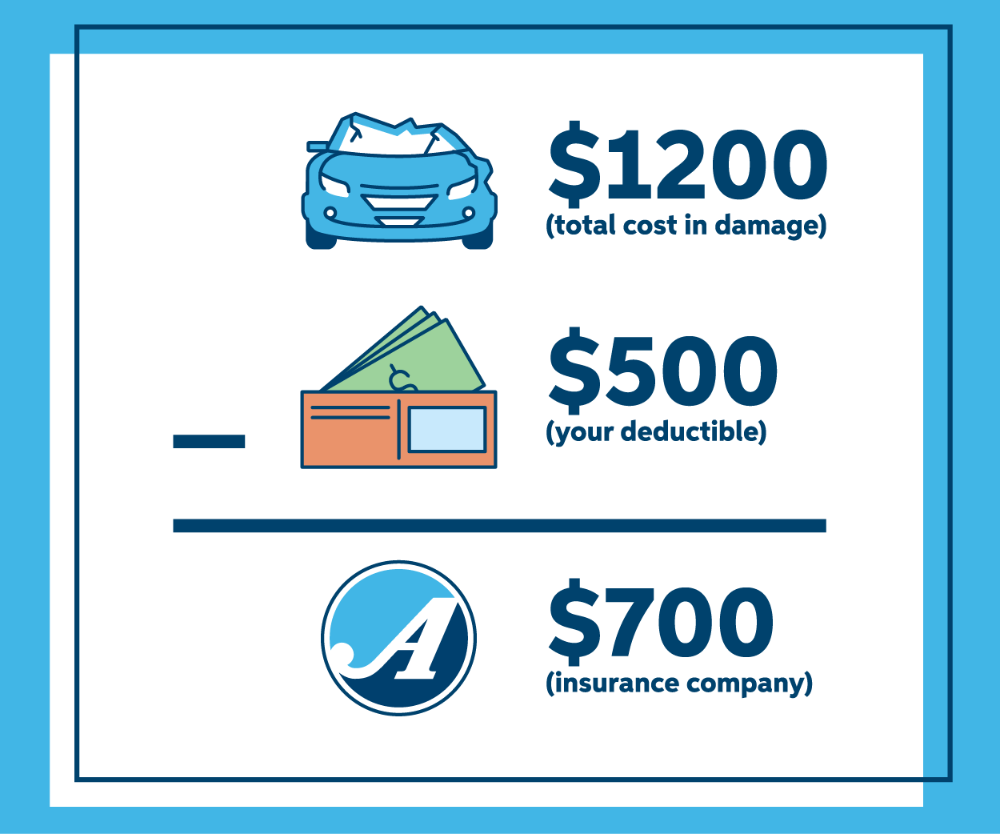

So, let’s say your car gets damaged in an accident. The total cost to repair the damages to your vehicle is $1,200. Your policy has a deductible amount of $500, which means you will need to pay $500 of the cost to repair. From there, your insurance will pay the remaining $700.

Read more: You Just Got Into a Car Accident. Now What?

Your deductible is a fixed amount that you select when you buy your policy.

So, even if the total cost to repair your car was $2,000, the amount that is your responsibility to pay would still be your $500 deductible amount, provided the damage is within the limits of your policy (more on that later).

Now, here’s where things connect.

When you select a low deductible, you will likely pay a higher premium. When you select a higher deductible, you will likely pay a lower premium since you’re footing more of the cost for a covered claim.

How much is my insurance deductible?

Your deductible will always depend on your policy’s terms and what you choose.

If you’re not sure what your current deductible amount is, you can find it in your policy documents. It is generally located on the Declarations page, near the front of your policy documents.

Be aware some policies may have deductibles specific to certain types of loss apart from the standard deductible. For example, a special wind/hail deductible.

For Auto-Owners policyholders, you can find your deductible amount in the policy Declarations section. To view your policy documents online, you can sign in at auto-owners.com.

If neither of those things helped you, your best bet is to call either your insurance agent or, if you bought your policy directly from an insurance company, you will need to call the insurance company’s customer service line.

Read more: What is an Independent Insurance Agent? Everything You Need to Know

What are insurance policy limits?

Your insurance policy’s limit is the most your insurance will pay toward a covered loss.

If your covered damages exceed your limit, you may need to pay out of pocket for part of the loss. This is why working with an independent insurance agent is so important. They can help you calculate and set appropriate limits so you don’t find yourself underinsured.

Being underinsured is when you have insurance coverage but the limits aren’t high enough to cover the full amount of your claim.

For most personal insurance policies, you will need to select a limit for both your property (your car, home, etc.) and your liability.

Many types of policies have additional coverages you can add to help cover costs if you exceed your limit.

Do you feel like you just crammed for a vocabulary test?

We get it.

That’s why we work with independent agents. They make all of this a lot easier. Since they’re experts with years of experience in your area, they can make sure you are adequately covered.

Auto-Owners Insurance Company © 2021. All Rights Reserved.

Disclaimer: The analysis of coverage is in general terms and is superseded in all respects by the Insuring Agreements, Endorsements, Exclusions, Terms and Conditions of the Policy. Some of the coverage mentioned in this material may not be applicable in all states or may have to be modified to conform to applicable state law. Some coverages may have been eliminated or modified since the publishing of this material. Please check with your local Independent Auto-Owners Insurance Agent for details.